Business Registration in Azerbaijan: Legal Entity Registration and Individual Entrepreneur Options

Understanding business registration in Azerbaijan is the foundational step for any entity or individual looking to commence commercial activities in the country. Business registration, indeed, is the first important step to starting lawful business activities in the country. Notably, Azerbaijani law grants foreign entities and individuals the same rights as residents when registering a business in Azerbaijan, making it an attractive destination for international entrepreneurs.

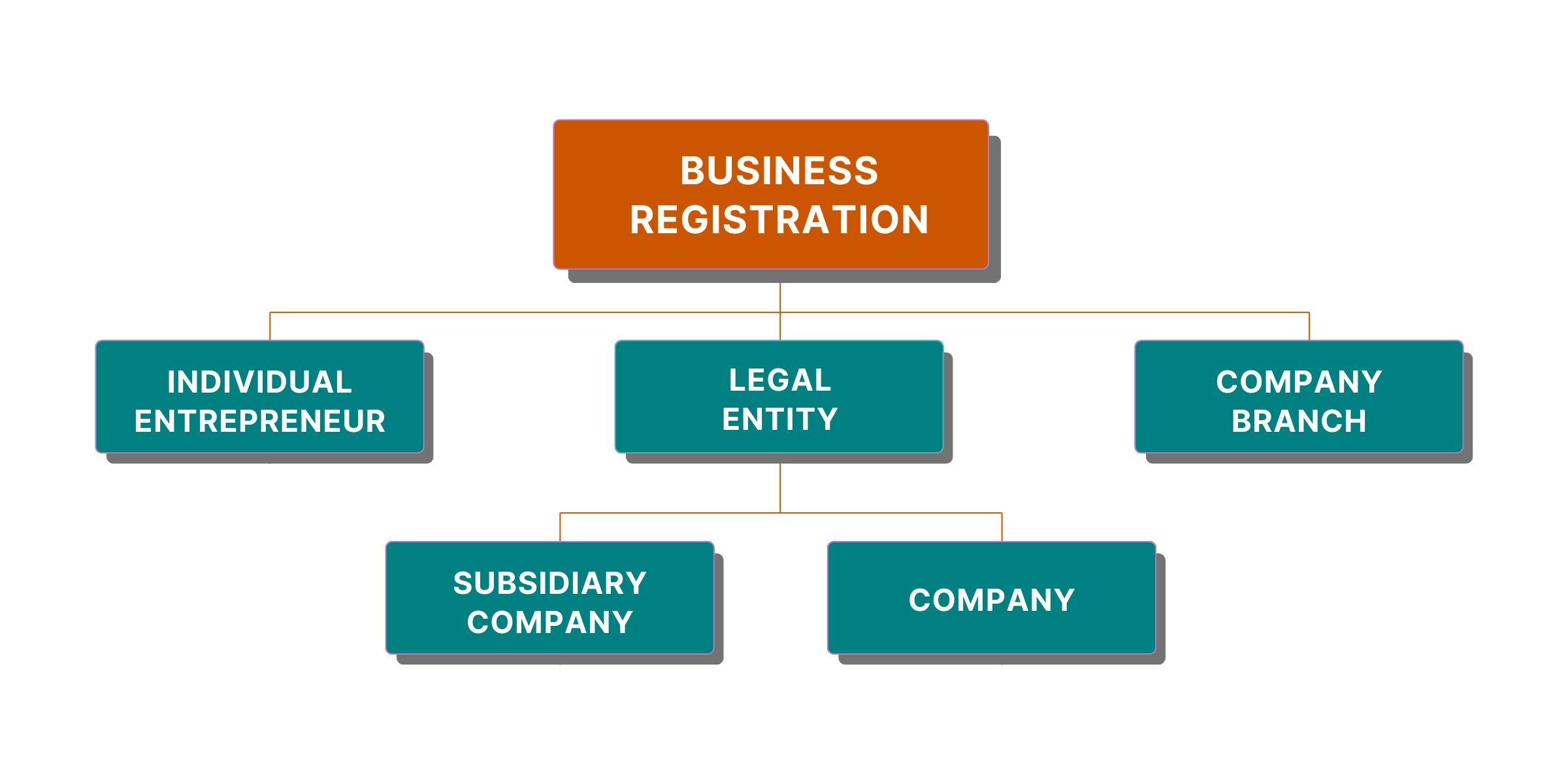

To legally start commercial activities in Azerbaijan, the law requires business registration in one of the following forms:

- Legal Entity: This option includes registering a company, such as a Limited Liability Company (LLC) or Joint Stock Company (JSC), as well as establishing a branch or subsidiary of an existing foreign company. This is preferred for structured, scalable business operations.

- Individual Entrepreneur: Ideal for single business persons operating independently without forming a separate legal entity. IEs are personally liable for business debts and obligations.

This guide provides comprehensive insights into the requirements and application process for company registration in Azerbaijan. Should you need expert legal assistance for business setup in Azerbaijan, our team at DLB Consulting has eight years of experience assisting clients globally, including renowned international firms.

Company Registration: Legal Forms and Required Documents

Company registration in Azerbaijan is the state registration of a legal entity planning to engage in commercial activities in the country. Indeed, company formation is the first important legal step for starting a business in the country. Notably, foreign individuals and businesses have the same rights as local individuals and entities to set up a company or subsidiary and engage in business activities in Azerbaijan.

According to Azerbaijan’s Civil Legislation, various organizational forms exist for companies. However, the most common and preferred legal structures for applicants looking to establish a company in Azerbaijan are:

- Limited Liability Company (LLC);

- Joint Stock Company (JSC).

LIMITED LIABILITY COMPANY (LLC)

A Limited Liability Company (LLC) is a legal form where the founders are not personally liable for the company’s obligations. This legal form encompasses the Private Limited Company (LTD), a widely recognized legal form in many countries.

In Azerbaijan, Limited Liability Companies (LLCs) can be formed by one or more individuals or legal entities. Importantly, there is no minimum charter capital requirement for registering a Limited Liability Company (LLC). Moreover, an LLC in Azerbaijan can be established as a sole proprietorship or a partnership.

JOINT STOCK COMPANY (JSC)

In Azerbaijan, founders often choose to register larger business entities as Joint Stock Companies (JSCs), a legal form that typically involves multiple shareholders. According to the Civil Law of Azerbaijan, there are two primary types of JSCs:

- Open Joint Stock Company (OJSC);

- Closed Joint Stock Company (CJSC):

Which Documents Are Required for Company Registration?

To register a company in Azerbaijan, applicants or their authorized representatives must submit the following documents to the State Tax Service:

- Application Form: The official application form for company registration.

- Company Charter (Articles of Association): This document outlines the company’s objectives, legal structure, registered address, and internal regulations.

- Decision on Company Establishment: A formal written decision by the founder(s) to establish the company.

- Identification Documents of Founders and Head: Valid ID copies (e.g., passports for foreign individuals) of all founders and the appointed head of the company.

- Proof of Payment: Official receipt confirming the payment of the state registration fee and the deposited Charter Capital (if applicable to the chosen legal form).

- Power of Attorney (if applicable): A legally valid Power of Attorney document if an authorized representative is submitting the application on behalf of the founder(s).

Subsidiary Company Registration

A subsidiary is a legally independent company that is controlled by another company (the parent company) or through a partnership of companies. Consequently, subsidiary registration in Azerbaijan is the state registration process for establishing a company that will be owned and controlled by another entity (or entities).

It’s important to note that a subsidiary in Azerbaijan must fulfill the same registration requirements as any other type of company. Furthermore, Azerbaijani legislation guarantees equal registration rights and requirements for both domestic and international companies seeking to register a subsidiary. However, foreign companies are required to legalize specific documents in accordance with international standards to complete the registration of a subsidiary company in Azerbaijan.

Which Documents Are Required for Subsidiary Registration?

To register a subsidiary company in Azerbaijan, applicants or their representatives will need to submit the following documents to the State Tax Service:

- Application form;

- State registration documents of the founding company (duly legalized);

- ID Copy of the head of the Founding company;

- The Charter of the subsidiary company;

- Decision on the establishment of the Subsidiary Company;

- Decision on the appointment of its head or legal representative;

- ID Copy of the head of the subsidiary to be registered;

- Receipt confirming the payment of the state fee and the Charter capital.

- Power of Attorney.

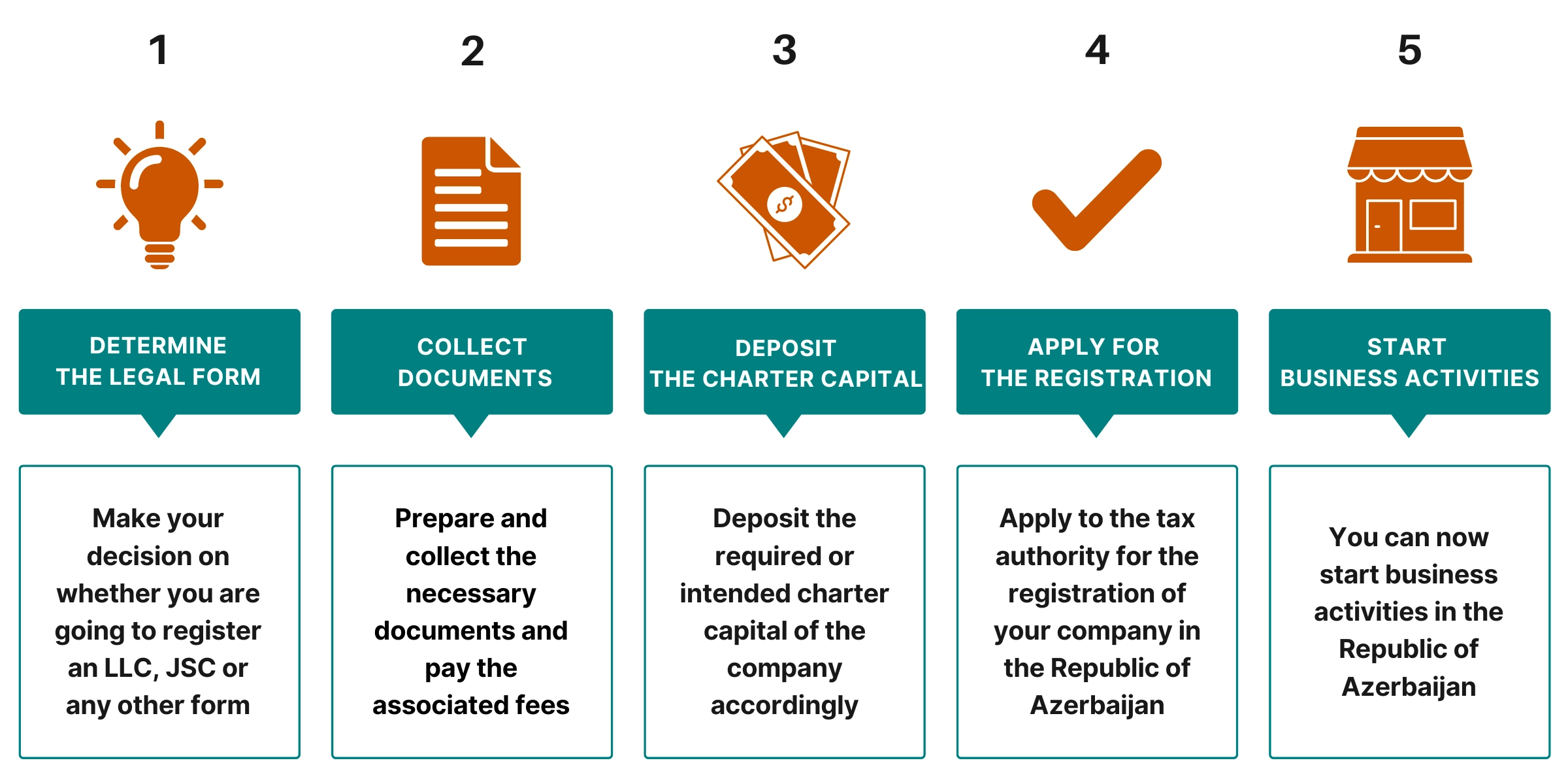

How to Register a Company in Azerbaijan: A Detailed Guide

STEP 1: Decide on the Legal Form and Name of the Company

- Determine the most suitable legal structure for your business activities—whether it is a Limited Liability Company (LLC), Joint Stock Company (JSC), branch, or subsidiary.

- Decide on the official name of the company you intend to register in Azerbaijan. It’s advisable to check the availability of your desired company name online to avoid potential conflicts.

STEP 2: Prepare and Collect Required Documents

- Once you have decided on the company’s legal form, prepare and collect the necessary documents according to the specific legal form.

- Note that all the registration forms and required documents are available exclusively in the Azerbaijani language.

- If you are going to register a representative office, branch, or subsidiary, ensure that all documents originating from foreign entities are properly legalized for use in Azerbaijan.

STEP 3: Pay the Fees and Deposit the Charter Capital

- Once you have completed collecting and preparing the necessary documents, ensure you pay the state registration fee. Currently, the state fee is 15 AZN.

- In parallel with paying the state fee, also ensure you have deposited the intended or required Charter Capital (Initial Capital). The Charter capital requirements can vary based on your chosen legal form and your desire. For example, while there is no minimum Charter Capital requirement for Limited Liability Companies (LLCs), the minimum requirement for Joint Stock Companies (JSCs) is 2,000 AZN (approximately USD 1,200).

STEP 4: Apply for and Obtain a Registration Certificate

- Submit the complete documents package, including proof of payment for the state fee and confirmation of the Charter Capital deposit, to the State Tax Service of Azerbaijan.

- Note that you can submit the documents online, in person, or through your legal representative.

- The registration process in Azerbaijan typically takes 3-5 business days from the date of submission. Upon registration, you’ll receive: Tax Identification Number (TIN), Registration Certificate, Company Charter.

STEP 5: Start Business Activities

- Once you have registered your company, you can now commence your business operations. It is important to obtain an ASAN Imza (electronic signature) and open a corporate bank account, as these will be necessary for conducting business activities in Azerbaijan.

- Note that certain types of businesses may require additional licenses or permits. The legislation specifies a select number of businesses that require a license (permit).

Legal Services for Company Formation in Azerbaijan

Should you require expert legal support for company formation in Azerbaijan or subsidiary registration, DLB Consulting is ready to assist. Our team offers professional legal services for business registration in Azerbaijan, coupled with comprehensive business consulting. We proudly serve clients globally, facilitating their entry into the Azerbaijani market

Remote Registration: By Proxy

Foreign companies and individuals can register a company or subsidiary company in Azerbaijan by proxy. DLB Consulting also provides professional legal services for remote company registration in Azerbaijan. Simply apply for our services and provide our lawyers with a power of attorney. Our legal team will manage the entire process of subsidiary or company formation, without requiring your visit to Azerbaijan.

Related Corporate Services

DLB Consulting provides the following consulting and legal services for foreign businesses and individuals planning to do business in Azerbaijan:

- Establishment of legal entities;

- Preparation of the Charter for the Company (Articles of Association) to be registered;

- Drafting, development and implementation of service agreements, codes of ethics, and compliance policies;

- Opening corporate bank accounts for the businesses to be registered;

- Obtaining business licenses for the required business activities;

- Legal and tax due diligence;

- Accounting and tax services;

- General legal and business consultation;

- Business Planning;

- Business Development Consulting;

- Corporate Legal Services.

Our

Clients

FAQ

Company registration in Azerbaijan is the state registration of a legal entity planning to engage in commercial activities in the country.

Yes, just like local companies, foreign companies can also apply to register their subsidiaries or branches in Azerbaijan. To do this, they simply need to collect and apostille (legalize) the required documents and apply through their representatives.

Yes, according to the law, it is very straightforward for foreigners to establish a company in Azerbaijan. In fact, they are subject to the same requirements as local citizens. All they need to do is gather and prepare the required documents and apply either themselves or through their representatives.

Generally, no — there is no minimum capital requirement to establish a company in Azerbaijan. Foreigners can start their business with any amount of capital they choose.

However, depending on the selected legal form, there may be minimum investment requirements. While there is no minimum initial capital requirement for Limited Liability Companies (LLCs), a charter capital of 2,000 AZN is required for Closed Joint Stock Companies, and 4,000 AZN for Open Joint Stock Companies.

Yes, the legal requirements for registering a company in Azerbaijan are the same for all foreigners, regardless of their citizenship. Therefore, it makes no difference whether the applicants are from the USA, Canada, Israel, the UAE, France, Germany, China, Pakistan, India, or any other country.

Yes, the legal requirements are the same for all foreign companies, regardless of their country of origin, when establishing branches or subsidiaries in Azerbaijan. There is no legal distinction whether the parent company is based in the USA, Canada, Israel, the UAE, Singapore, France, Germany, China, Pakistan, India, or any other country.

Yes, it is possible to register a company in Azerbaijan without visiting the country. All a foreign individual or company needs to do is provide an apostilled (legalized) power of attorney to their legal representative in Azerbaijan.

In addition to the power of attorney, foreign companies must also provide apostilled (legalized) registration documents of the parent company. This allows the legal representative to complete the registration process without the need for the foreign applicant to be physically present.

No, there is no legal requirement to have a local partner when opening a company in Azerbaijan. Unlike in some other countries, foreign individuals or companies can own 100% of the company’s shares.

In Azerbaijan, company registration is a one-time process and remains valid indefinitely. There is no need for renewal or extension, and no annual registration fees are required.

Yes, foreign individuals who are residents of Azerbaijan can apply for company formation online. However, foreign companies and non-resident foreign individuals are not eligible to register a company online.

In Azerbaijan, the State Tax Service typically registers a company within 3 to 5 business days, provided that all required documents are properly submitted.

Currently, the state fee for company registration in Azerbaijan is approximately 15 AZN. However, please note that additional costs may apply for notary and translation services. You may also require legal assistance to ensure compliance with local laws, and consulting firms may charge varying service fees depending on your specific needs.

The general corporate tax rate for businesses in Azerbaijan is 20%. Additionally, there are tax exemptions and incentives available for certain types of businesses.

The general VAT rate for businesses in Azerbaijan is 18%. Additionally, please note that certain specific business activities and services are exempt from VAT.